There’s a moment when you realize you’re tired of just surviving and ready to start thriving. For me, that moment was fueled by words—the kind of words found in the pages of powerful books. These 7 books weren’t about dry financial theory; they were about rewriting my financial story. They taught me how to save, how to invest, and, most importantly, how to break free from the cycles that kept me stuck. They transformed my financial life, and I genuinely believe they can transform yours. Whether you’re just starting out or ready to level up, prepare for a financial journey that feels less like a struggle and more like a breakthrough.

1. Rich Dad Poor Dad by Robert Kiyosaki

If you’ve only heard of one personal finance book, it’s probably this oone—nd for good reason.

Kiyosaki breaks down the difference between how the rich and the poor think about money, work, and investing. His core message: “Don’t work for mmoney;make money work for you.”

This book made me think about assets and liabilities in a different way, making me move from being a spender to an investor.

I think this book provides amotivationaladvice rather than concrete financial strategies. Furthermore, it is oversimplifying the path to wealth and overly disparaging traditional education and employment.

My advice: Read for a motivational mindset shift about assets, but avoid if you seek practical, detailed financial advice.

2. The Psychology of Money by Morgan Housel

Money isn’t mmath—t’s emotions, habits, and beliefs. Morgan Housel eloquently describes how our money behavior tends to be more important than technical smarts.

Each chapter feels like a great essay, explaining why individuals make illogical money cchoices—nd how to rectify that.

This book changed me from chasing quick wins and instead building riches slowly and durably.

Housel’s core arguments—that doing well with money is more about bbehaviorthan iintelligence nd that luck and risk play significant roles—are essentially common sense dressed up in engaging anecdotes. While reading I find the book’s principles to be basic or repetitive, suggesting that the ideas could have been conveyed in a long-form article rather than a full book. This book does not offer sophisticated or actionable advice for experienced investors and occasionally oversimplifies economic concepts.

My advice: Read for insightful, behavioral lessons about money and decision-making, but recognize the advice is more conceptual than tactical.

_____________________________________

3. Your Money or Your Life by Vicki Robin

This is not a book about money — it’s a book about life.

Robin helps readers align their spending with their values and shows how every dollar represents time from your life. It’s powerful, especially if you’re trying to simplify and gain control.

Made me realize money isn’t just about aaccumulation—t’s about freedom and purpose.

While widely celebrated as a foundational text for the FIRE (Financial Independence, Retire Early) movement, I think this book has some outdated financial examples and a somewhat rigid approach that may not suit modern readers.

My Advice: Read for a philosophical approach to valuing your time over money but be aware that much of the financial advice is outdated.

4. The Millionaire Next Door by Thomas J. Stanley

Surprise: most millionaires don’t drive Lamborghinis or live in mansions.

This book shows how actual millionaires live simply, invest effectively, and steer clear of lifestyle creep. It shatters the flashy Instagram concept of wealth.

Altered my thinking from “how much you earn” to “how much you keep.”

I would praise this book for demystifying wealth and highlighting the power of frugality, but recent data and potential survivorship bias. Published in 1996, its statistics and examples may not fully reflect contemporary economic realities or the diverse paths to wealth.

Read if you want a research-based profile of frugal millionaires, but understand the data and demographic focus are dated.

My Advice: Read if you want a research-based profile of frugal millionaires, but understand the data and demographic focus are dated.

5. I Will Teach You To Be Rich by Ramit Sethi

This is probably the most actionable book on personal finance available. It has all the bases covered — budgeting, saving, credit cards, investing, and even guilt-free spending — in a funny, no-BS voice.

Sethi promotes automating and thinking long-term over trying to catch every penny.

This book provided me with a real plan I could begin using the same day — including installing automatic savings and investing in index funds.

While widely popular for its actionable, no-nonsense approach to personal finance, I would not agree with its prescriptive, “set it and forget it” methodology, which may oversimplify the complexities of individual financial situations. Sometimes aggressive tone and marketing-heavy undertones—particularly the emphasis on “Conscious Spending” as a means to afford luxuries—can feel exclusionary or overly focused on a specific, high-earning demographic, potentially alienating readers seeking a more traditional or foundational approach to saving.

My Advice: Read for a clear, actionable roadmap to automate finances and negotiate better rates, but skip if you prefer a traditional or less marketing-focused approach.

6. The Intelligent Investor by Benjamin Graham

Written by the mentor of Warren Buffett, this classic is for those ready to understand the principles of value investing.

It’s dense, but incredibly valuable. If you’re serious about long-term investing, this book will guide your thinking like a pro.

Taught me the difference between speculating and investing — and gave me the courage to start.

I think this book is dense, and at time feel it would be difficult for the average reader to navigate. Some of book’s specific examples, investment rules, and financial instruments are no longer relevant in today’s rapid-paced, tech-driven markets and reader has to translate its application in present tech era.

My Advice: Read for timeless principles on value investing and market behavior, but expect a dense and complex text requiring significant effort.

7. Think and Grow Rich by Napoleon Hill

It’s less about finance and more about attitude, but this book is still one of the most quoted in the personal development community. Hill consulted with hundreds of millionaires to discover common characteristics and principles for success.

Reminded me that daily discipline and belief are key to creating wealth.

While celebrated as a pioneering work in the self-help and motivational genre, this book has reliance on anecdotal evidence, vague principles, and in some sections a lack of scientific rigor. Mere thought can manifest wealth through abstract concepts like “The Master Mind” and “Autosuggestion”—is unproven and bordering on pseudoscientific. of inspiring fables than a practical guide to financial success

My Advice: Read for motivation and confidence-building but avoid if you expect concrete financial strategies based on modern research.

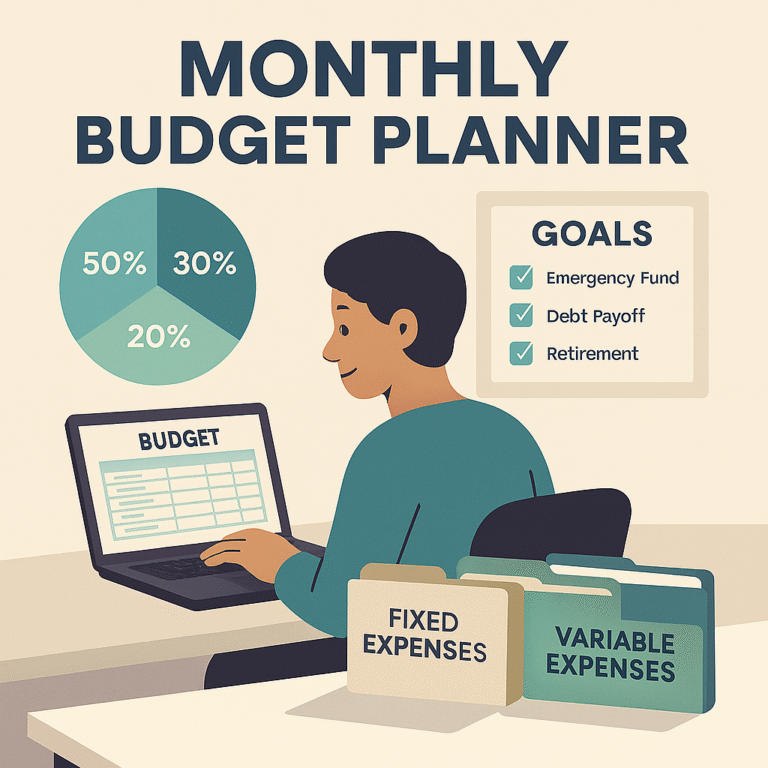

Looking for other tools to help you manage your money? Explore our full suite of free Financial Calculators.

Final Thoughts

These books not only transformed my money smarts — they transformed the way I think, live, and prepare for the future.

Begin with the one that best reflects your current circumstance. Looking to begin budgeting? Begin with Your Money or Your Life. Looking to invest wisely? Opt for The Intelligent Investor. Looking for a complete mindset overhaul? Think and Grow Rich is your way to go.

Remember that the strongest wealth asset you will ever possess is your mind. Feed it with the proper concepts.

–-> Learn more: Financial Literacy 101: How to Master Money Management

Affiliate Disclosure: I am an Amazon Associate and earn from qualifying purchases with no additional cost to you.

One Comment