Do you ever wonder if becoming a millionaire is just a fantasy? It isn’t! Becoming a millionaire isn’t about being lucky; it’s about making smart choices and taking a little time. If you regularly save and invest, achieving that $1 million net worth is well within reach of most individuals. It’s a marathon, not a race.

To make this journey clearer, we developed a free millionaire probability calculator. It’s not a basic savings tracker; it’s a calculator that makes you visualize your millionaire journey. It displays your millionaire probability percentage, approximates the number of years it will take to be a millionaire, and offers you personalized advice on how to get there sooner.

In this blog, we will describe how our calculator works, what most influences your financial independence, and how you can increase your chances of becoming a millionaire.

How Our Free Millionaire Calculator Works

Up for a quick checkup of your finances? Our millionaire calculator is easy to use and will only take a few minutes. You will respond to 10 straightforward questions regarding your age, income, savings, debt, and how you invest your funds.

After you input your information, the millionaire calculator provides you with a customized report that shows:

- Your millionaire likelihood percentage

- How long it could take to become a $1 million millionaire

- Your rate of savings

- An estimate of how much money you could have at retirement

- Customized advice on ways you can boost your millionaire score

Consider it your own personal financial GPS. It tells you where you are now and how you can get where you want to be.

What Impacts Your Odds of Becoming a Millionaire?

Your odds of becoming a millionaire are based on a few major factors. The more you know about them, the better you’ll do!

1. Your Age: The Power of Time

Want to know the single most influential factor? Time! The sooner you start saving, the better. This is due to compound interest, with your money beginning to earn more. For instance, someone aged 25 saving only $500 a month can accumulate more than someone aged 40 saving $1,000 a month!

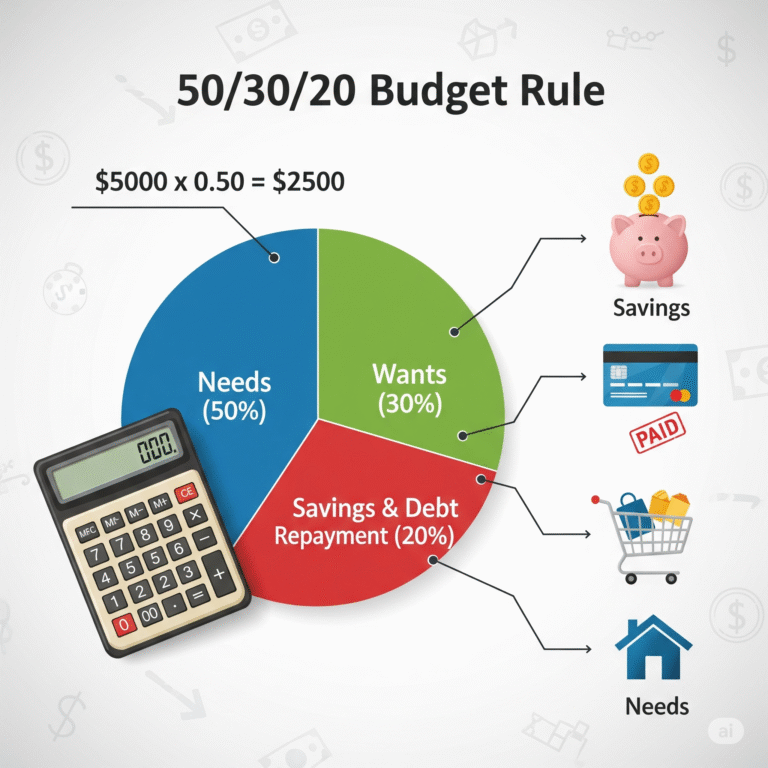

2. Your Savings Rate: The Key to Wealth

Your savings rate is the percentage of your income that you save. That is more important than how much you make. Whether you earn much or little, if you save a big percentage, you’re doing well. Most experts suggest a savings rate of 20% or higher.

3. Your Investment Strategy: Conservative vs. Aggressive

The way you invest your money makes a tremendous difference. Here’s a brief overview:

- Conservative (4% returns): Growth that is more modest and secure.

- Moderate (6–7% returns): A balanced mix of risk and reward.

- Aggressive (10% returns): Higher growth and, consequently, higher ups and downs.

- Mixed (6% returns): A customized blend of various styles.

4. Debt and Expenses: Your Financial Roadblocks

High-interest debt (such as credit card debt) and high monthly payments are a heavy anchor. They weigh down your path to financial independence. The more debt you have, the longer it will take to reach your destination.

5. Risk Tolerance: Staying the Course

Can you stomach watching your investments lose a bit in a poor market? If so, you’re more likely to reap the long-term rewards of the stock market. Long-term investing is a marathon, not a sprint.

Can You Still Become a Millionaire? Simple Ways to Improve Your Score

Even if your early returns are low, don’t panic! You can easily make adjustments to get back on track.

- Save More Money: Make efforts to save up to 20% of your income. This easy and free Monthly Budget Planner yet potent tool is the cornerstone of financial health, taking you from a place of uncertainty to confidence and control.

- Pay Off Your Debt: Pay off the high-interest debt first. This is one of the quickest ways to maximize your millionaire chances. Our Credit Card Payoff Calculator assists you in planning achievable repayment objectives, witnessing how extra payments payoff your debt quicker, and paying less unnecessary interest.

- Create an Emergency Fund: Save 6 months of living costs. This prevents you from drawing on your investments. Use our free Emergency Fund Calculator to calculate How much you should save for emergencies

- Invest for Growth: The stock market has traditionally yielded higher returns than a savings account. With our free ROI Calculator, you can easily calculate your percentage return, annualized performance, and even your net profit after expenses. Try this fast quiz to find out your risk profile and optimal portfolio composition

- Use Retirement Accounts: Make the most of your 401(k), IRA, or other retirement plan to save taxes and make your money grow.

For a more complete picture of financial guidance, you can visit reliable, official sites The Financial Literacy and Education Commission

Is $1 Million Still Enough to Retire?

That’s a valid question! A millionaire is an individual with a net worth of $1 million (your assets minus your liabilities). But considering inflation, that amount may not seem as large as before.

While $1 million is a fabulous goal, most experts recommend targeting $2 million to $3 million so you can retire in style. The true objective isn’t a numbe,it’s freedom and the ability to do what you desire.

Ready to Discover Your Millionaire Likelihood?

Our online millionaire likelihood calculator is free to use and will reveal to you:

- Where you currently are

- How many years it may take to become a millionaire

- What you have to do to arrive sooner

Becoming a millionaire has nothing to do with luck. It has everything to do with simple arithmetic and self-control. Use our free calculator today and begin making small, incremental changes. Every millionaire began somewhere, often with their initial $100 saved!

FAQs – How to Become a Millionaire: Try Our Free Calculator

Q: Can I still become a millionaire if I’m over 40?

Yes,if you save aggressively and invest smartly, it’s still possible.

Q: Is $1 million enough to retire?

Depends on your lifestyle. In some places, yes. In high-cost cities, you may need more.

Q: What’s the fastest way to increase my millionaire probability?

Increase your savings rate and cut unnecessary spending.