Young Americans fantasize about homeownership but are discouraged by high prices for homes and enormous down payments. Median U.S. home prices, after all, reached around $422,400 in July 2024, and 20% down (usually ~$84k) feels like an impossible dream on a first job salary. Fractional real estate investing comes to the rescue. Instead of purchasing an entire house, you can invest through real estate crowdfunding platforms to purchase a piece of property. Essentially, you purchase a fraction of rental houses or office buildings with an investment of just $100. This new paradigm allows you to enter the game of real estate with little cash – setting the stage for passive real estate income.

Think of putting $100 (or $10 in some apps) down on a piece of a rental property and receiving regular rent checks and benefiting from any future growth. Arrived Homes’ CEO explains how this model is “working – 58% of Arrived users born after 2000 start with an investment of just $100“

In plain terms: even Gen Z is using tiny starter amounts to build real wealth. In this guide we’ll break it down: what fractional investing means, how it works, how it compares to traditional real estate, and even success stories of beginners who started small. Ready to learn how to invest in real estate with little money? Let’s dive in.

What Is Fractional Real Estate Investing?

Fractional real estate involves owning part or share of a property, as opposed to purchasing the entire property. Consider it as real estate crowdfunding: a business purchases a building or rental house, subdivides it into shares, and distributes those shares to numerous investors. Every shareholder subsequently receives a proportionate portion of the rental revenue and any appreciation in value. You have the advantage of real estate – steady cash flow and appreciation – but without the necessity of dealing with tenants, making repairs, or acquiring a behemoth mortgage.

For instance, a website may purchase a $500,000 rental property and divide it into 5,000 shares. If you purchase 10 shares for $100, you own 0.2% of the property. When the landlord receives rent, you receive 0.2% of the money every quarter, and when the house is finally sold, you receive 0.2% of the proceeds. It’s a passive income plan: you “invest in” with little cash and relax while the platform does the rest. Importantly, fractional investing has extremely low entry costs. Rather than requiring $50,000+ or ideal credit, most platforms allow you to begin with a mere $100 (or even $10 with Fundrise)

This brings real estate within reach and makes it more affordable, particularly in high-priced markets such as NYC or SF where the minimum stake could be several hundred dollars. Briefly, fractional ownership brings real estate down to earth: now everyone can have skin in the game with pocket money.

How Does Fractional Investing Work?

Starting out is usually as easy as signing up on a real estate investing app. Here’s the simple procedure:

- Select a platform and surf deals. You’ll be looking at lists of properties (houses, apartments, offices, etc.) or diversified funds. Every listing indicates the cost per share and the number of shares available

- Purchase shares. Determine how much you would like to invest (say, $100 or $1,000) and buy that number of shares. The platform does the paperwork and pool of shareholders.

- Earn passive income. After the transaction closes, the real estate earns rent. The rental income is paid out to you as quarterly dividends (similar to a dividend stock)

- Your portion of rent increases if you hold more shares. In the future, the real estate may even appreciate in value, and you benefit when it’s resold.

- Exit (if necessary). Real estate is a long time, so most investments have 5–7 year lock-ups. That being said, some sites now include limited liquidity or secondary markets. For instance, Arrived Homes lets you request a redemption after 6 months and Lofty.ai provides a token-based marketplace. Just keep in mind that liquidity is typically lower than stocks – you may not be able to cash out right away

- That is, fractional investing makes traditional real estate steps a snap. You’re investing in a property without the landlord hassle. The platform manages tenant issues, repairs, and even refinancing. You simply invest your money and, “watch your investments grow through quarterly rental income dividends”

Analyzing Top Platforms for fractional real estate investing

Most real estate crowdfunding sites now compete for investors. Here’s an unbiased overview of some of the biggest players for beginners:

Fundrise:

Well-known for low minimums. Fundrise allows you to begin with a mere $10. It provides diversified real estate funds (eREITs and eFunds) as opposed to individual properties, so you have immediate exposure to dozens of properties. Fundrise keeps fees low (approximately 0.15–1.85%) and includes automatic reinvestment options. Its plans – such as a Growth Plan or Income Plan – are designed for various objectives. On the positive side, anyone (accredited or not) can invest, and you can withdraw anytime (with a modest penalty if prior to 5 years). Liquidity is the trade-off: Fundrise portfolios should be held for 5+ years, and early redemptions come with a 1% fee

RealtyMogul:

An established platform providing both commercial REITs and single properties. If you’re not accredited, RealtyMogul still allows you to purchase shares in public or non-traded REITs (e.g. an Income REIT or Apartment Growth REIT). That is consistent dividends from sizable portfolios of real estate. If you are an accredited investor, you can also co-invest in individual deals (office buildings, complexes) – although those have steep minimums ($25k–$50k). For newbies, the trade-off is the heavy entry: you’ll need at least $5,000 to invest in their REITs. Pros: vetted deals, some regular income, no landlord responsibilities. Cons: high minimum, money tied up for at least a year (often more), and only REITs open to non-accredited investors

Arrived Homes (Arrived):

Targeting residential rental homes (and vacation homes), Arrived allows you to choose individual homes in which to invest. It has a very low $100 minimum, and it’s easy for newbies to understand. You receive quarterly dividends on rent and participate in any profit appreciation. Arrived also provides two managed funds (similar to a portfolio of multiple houses) for immediate diversification. A big bonus: after six months you can ask for a payout on your fund shares, which helps to provide some liquidity. They even include properties such as a well-known Netflix show house, which received quite a bit of publicity. Negatively, Arrived’s fees are somewhat high and each property has a 5–7 year hold period. It’s really passive (they do the renovations, tenants, etc.), but you need to be okay with tying money up in long-term or utilizing their glacial secondary market.

Bottom line: Fundrise is ideal if you want the easiest start ($10, passive funds). RealtyMogul is great if you have several thousand to invest in more commercial deals. Arrived is perfect if you want hands-on choice of rental homes and can start with $100. Each has its own fee structure, so compare annual management fees and any performance fees. All these are instances of popular real estate crowdfunding platforms earning passive income on real estate within budget

Real-Life Examples: Newbies Starting Out

- Don’t just take our word for it – real people have had success as well. For instance, Arrived Homes says more than half of their Gen Z investors begin investing with just $100. As their VP explained, young adults “build their wealth and invest in real estate without having to pinch pennies and save for a down payment”

- I love that I can diversify $1,000 over ten rental properties…In ten states, no less, noting that with every investment I make, I add another source of passive income.. Even modest moves pay off: I used Arrived for diversification, in addition to other real estate investments, to generate long-term cash flow.

- That remark indicates how easy it is to use these platforms. Instead of a shrunk condo or gigantic loan, this individual merely dipped their toe into real estate using pocket money. With time, that $100 can multiply in the form of dividends and property appreciation – all without the burden of outright property ownership.

Advantages and Disadvantages of Fractional Investing

Investing by the slice has a lot of benefits, but like any investment it also has its trade-offs. Here’s a brief summary:

Advantages of fractional Ivesting :

- Low barrier of entry: Most sites allow you to invest as little as $100 (or $10)

- No 20% down payment or massive credit check is required.

- Diversification: With small amounts you can own shares of several properties in various places, diversifying your risk. (As one investor put it, $1,000 can purchase pieces of 10 different houses across 10 states

- Passive Income: You collect rental cash flow and dividends without owning the property. Quarterly payments show up in your account, like clockwork

- Professional Management: Websites screen deals and take care of maintenance, vacancies, legalities, etc. You reap their due diligence and expertise

- Accessibility: Most websites are available to all investors, accredited or not

- This makes high-end real estate accessible to beginners.

Disadvantages of fractional Investing

- Limited Liquidity: Not like stocks you can sell whenever, these investments tend to keep you locked in for years. For instance, single-family home transactions typically come with a 5–7 year target hold. Even with secondary markets, be prepared for delays and (occasionally) fees.

- Market Risk: Real estate values can drop. An economic slump or local area downturn could cut into your share of proceeds.

- Platform Fees: All operators levy upfront sourcing fees and ongoing management charges (usually ~1%+ of assets). These are carved out of returns, so compare fee structures

- Early Exit Penalties: If you do need your cash, some platforms penalize taking money out early before a few years or never. For example, Fundrise charges a 1% penalty on early redemptions

- Greater Risk Than Stocks: Fractional real estate is individual investment. Potential returns are greater than index funds – as are potential losses.

- Basically, fractional investing allows new investors to tap into large real estate, but it’s a marathon. You give up liquidity for access and potential profits. Always treat it as a portion of a diversified portfolio, not all your cash.

Tips for Getting Started : Fractional Real Estate Investing

If you’re intrigued, here are some tips to evaluate platforms and make your first moves:

- Compare minimums and investments. Some apps (Fundrise) start at $10; others (RealtyMogul’s REITs) start at $5,000. Pick one that matches your budget. Also check if they focus on residential vs. commercial, or debt vs. equity deals.

- Review fees and lock-in periods. Read the small print: what are the management fees and transaction fees, and how long is your cash locked up? Fewer fees and shorter lock-ups are more welcoming to new investors.

- Check track records. Find sites that provide clear-cut histories. Some release historic deal performance or carry B+ credit ratings (BBB). Well-established businesses with venture capital backing (such as Arrived supported by well-known investors) can provide additional assurance

- Take auto-invest options into account. For ultra-passive real estate investing, select platforms that allow you to automatically reinvest dividends or specify rules to purchase new shares. This “set and forget” strategy will compound growth.

- Begin small and diversify. You may join accounts on several sites. Even a few hundred dollars divided among two sites can illustrate how each operates and what you like. One user at SparkRental mixes Arrived home shares, Fundrise REIT funds, and other investments – each providing a stream of passive income

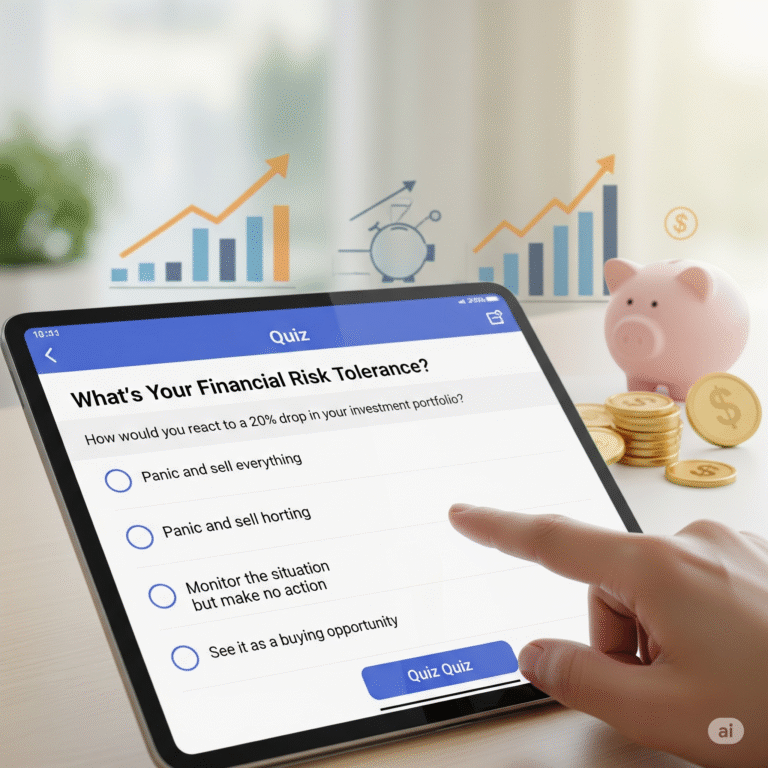

- Align with your goals. Real estate crowdfunding is typically a long-term strategy. Business Insider encourages us to ensure “it aligns with your risk tolerance and time horizon”. If you’ll need cash in 1–2 years, this might not be the best place. But if you’re planning 5+ years and growing wealth, it might be ideal.

- Stay informed. Unlike stocks, these are private investments. Read every offering document, ask questions, and even consult a financial advisor or tax pro about how dividends and capital gains will be taxed.

By following these steps, you’ll use the power of real estate crowdfunding platforms wisely. They exist so that average people (with little savings) can join a market once reserved for wealthy insiders.

Ready to Take the First Step?

Fractional real estate investing is removing the “all-or-nothing” risk of buying property. Instead of being locked out, you get a seat at the table. As you’ve seen, investing in real estate with just $100 is not only possible, but already happening. Whether you crave passive income, portfolio diversification, or simply want to own real estate in your 20s, platforms like Fundrise, RealtyMogul, and Arrived Homes make it doable

That first share is the first step on the path from $100 to financial independence. Picture five years down the road, receiving quarterly checks from rental income you helped finance. Or selling your interest in a red-hot property and enjoying profit you never expected with your initial $100. All the big-time real estate tycoons began small – so why can’t you? With diligent research and a little patience, fractional investing might just be the launching pad to long-term riches.

So why not? Try a platform today, invest that initial $100, and start building your future. Real estate is no longer the preserve of the ultra-rich – it’s a brick-by-brick path that you can follow, one hundred dollars at a time.

Fractional Real Estate Investing FAQs

- What is fractional real estate investing?

Fractional real estate investing is a way of owning a piece or “fraction” of a property, like a rental home or office building. Rather than purchasing the whole property, you buy shares, frequently as low as $10 or $100, and become an owner. - How is fractional real estate different from traditional homeownership?

In contrast to conventional homeownership, fractional investing does not necessitate a significant down payment, mortgage, or work with tenants, maintenance, or property management. It enables you to have exposure to property and collect passive income in the form of rental income and property appreciation with a much lower investment. - What are the primary advantages of fractional real estate investing?

The main benefits are a low barrier to entry (minimum investment is low), diversification (you can invest in several properties), and passive income. You get regular rental income dividends without having to deal with the hands-on hassle of being a landlord. - What are some of the popular platforms for this type of investing?

Established sites include Fundrise (for its low $10 minimum and diversified portfolio), Arrived Homes (individual residential and vacation properties with a minimum $100), and RealtyMogul (commercial REITs as well as individual offers). - Is fractional real estate investing liquid?

No, it is not as liquid as stock. The majority of platforms recommend a minimum hold period of 5 or 7 years. Although secondary markets or redemption programs are available on some platforms, it may take fees or time to cash out your investment. - Is anyone able to invest in fractional real estate?

Indeed, the majority of the well-known real estate crowdfunding platforms are available to everyone, as opposed to accredited investors only. This one of the primary reasons why it is a favourite among novice investors.