Your twenties are full of firsts—the first job, paycheck, apartment… and probably your first experience with adult financial responsibilities. But with the freedom comes stress: student loans, rent, credit cards, and the constant question:

“Where do I even start with managing my money?”

If you ever felt lost or confused about finances, know that you’re not alone. Learning to be financially smart in your 20s is one of the best investments you’ll ever make—and the sooner you begin, the higher your return.

Learn More: Financial Literacy 101: How to Master Money Management

1. Why Your 20s Matter Financially

Based on a 2024 TIAA study, about 65% of young adults have minimal financial literacy—from budgeting, to managing debt, to saving for retirement. That is to say, most twenty-somethings are flying blind when it comes to money.

But these years set the tone for habits for a lifetime. How you approach money now will affect your:

• Credit score

• Ability to choose your career path

• Ability to buy a home

• Security in retirement

Consider financial literacy as not math—but as your freedom plan.

2. Common Money Challenges in Your 20s

Most young adults encounter these money challenges early in life:

• taking home just about every paycheck

• senior student loans and credit cards

• no budgeting or financial planning

• lure of lifestyle inflation and FOMO spending

• no or little emergency funds

• falling victim to online scams or “get rich quick” programs

3. Seven Financial Habits to Build Now

These no-nonsense habits will guide you toward financial confidence:

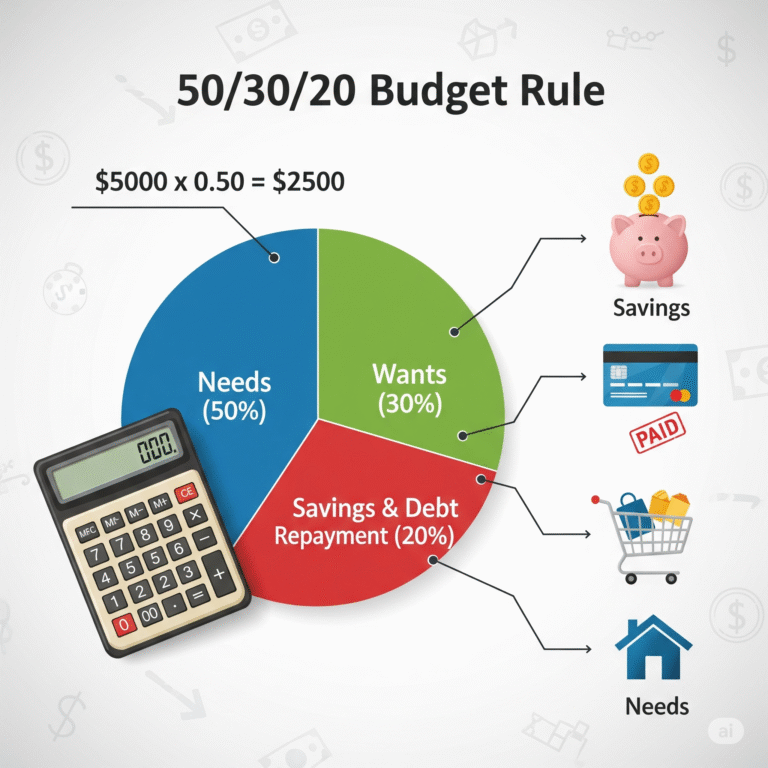

3.1 Create a Budget That Works for You

Use free Monthly budget calculator/planner , or EveryDollar to establish spending limits and savings goals.

3.2 Track Every Dollar

Small leaks sink big ships. Discover where your money is going with apps or even a simple spreadsheet.

3.3 Know Credit and Debt

Learn how credit scores function, how interest is figured, and why minimum payments are not sufficient. Keep credit utilization below 30%.

3.4 Begin an Emergency Fund

Target at least $500–$1,000 to start with, and scale it up to pay for 3–6 months of expenses eventually. Use our Emergency Fund Calculator – How Much Do You Need to Save?

3.5 Invest Early (Even If It’s Small)

Begin investing in ETFs or index funds through platforms such as Acorns, Fidelity, or Robinhood. Even $20/month creates habits and compounding returns. use our tool Millionaire Calculator – How Long Will It Take To Be a Millionaire?

3.6 Avoid Lifestyle Creep

Just received a raise? Don’t raise everything. Delay gratification and put additional income towards debt or savings.

3.7 Learn How to Earn More

Negotiate your pay, build valuable skills (e.g., coding, freelancing, design), or start a side hustle to increase earnings.

Looking for tools to help you manage your money? Explore our full suite of free Financial Calculators.

4. Bonus: Don’t Ignore Insurance

Medical emergencies and accidents can set back finances. Ensure you have:

• Health insurance (at work, government-sponsored, or private)

• Renter’s insurance if not living with parents

• Car insurance if driving

5. Learn from the Best: Recommended Resources

Top Financial Literacy Books

- “I Will Teach You to Be Rich” by Ramit Sethi

- “Your Money or Your Life” by Vicki Robin

- “The Psychology of Money” by Morgan Housel

Online Courses

- Financial Planning for Young Adults – Coursera

- Khan Academy – Personal Finance Series

- Skillshare – Side Hustle & Investing Basics

Useful Tools & Apps

- Budgeting: YNAB, Mint, EveryDollar

- Investing: Robinhood, Acorns, Fidelity

- Learning: Audible, Skillshare, Coursera

6. Take the Free 30-Day Financial Literacy Starter Challenge

Ready to give your finances a boost?

Download our FREE 30-Day Financial Literacy Starter Challenge—a one-month action plan filled with:

• Budgeting worksheets

• Daily savings goals

• Mini lessons on credit, debt, and investing

• Motivation tips and habit trackers

Get the challenge now and begin building financial confidence—one day at a time.

7. Final Thoughts

Financial literacy is not about doing it perfectly—it’s about being deliberate. The earlier you take charge of money, the greater the freedom, stability, and peace of mind you will enjoy.

Your 20s aren’t only a decade to navigate life—they’re your catapult to a rich, independent future.

FAQs: Quick Answers for Beginners

What’s the first step to becoming financially literate in your 20s?

Start by tracking your spending and creating a basic budget using free tools like Mint or YNAB.

Is it too early to invest in your 20s?

No! The sooner, the better. Even modest investments have time to compound.

Do I have to pay off all my debt before saving or investing?

Not necessarily. It’s wise to balance paying off debt with saving, particularly for emergencies.

One Comment