Handling your finances can appear daunting in the current fast-paced era. Financial independence is achieved through recognizing the basics and making regular, intelligent decisions. In this blog, we delve into what personal finance is all about, suggest investment ideas suited for a salaried individual, and point out common pitfalls so that you may prevent them and construct a sound, prosperous financial future.

The Larger Picture

Personal finance is not only saving or even investing; it’s building a mindset that appreciates financial discipline, lifelong learning, and forward-thinking decision-making. As emphasized in Rich Dad Poor Dad book, a change of heart from just getting a salary to thinking like an investor is imperative. This change can revolutionize how you perceive risks, rewards, and opportunities—regardless of whether you start with a small monthly income.

By understanding these cornerstones of personal finance, you’re not only learning to save a little extra; you’re putting yourself in the position to make smart financial decisions and create a future that aligns with your vision.

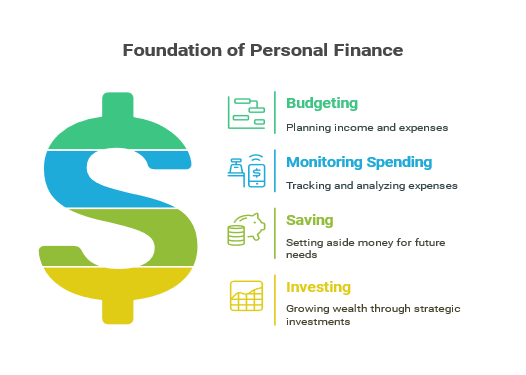

Building a Solid Financial Foundation

Even before you get your feet wet in investing, it’s crucial to establish a solid financial foundation. This involves adopting a few good habits that will last for a lifetime:

1. Set a Clear Budget

Why Budgeting Matters: A well-planned budget provides an honest snapshot of your monthly income and expenses. Begin by listing all sources of income, then document fixed costs (like rent, utilities, and insurance) and variable expenses (such as entertainment, dining out, and shopping). The goal is to ensure your expenses never exceed your earnings.

Actionable Tip: Get organized using budgeting software or even just a spreadsheet. Most beginners enjoy the “50/30/20″ rule (50% needs, 30% discretionary spending, 20% savings and debt repayment) as an easy-to-use guideline.

Try 50/30/20 Budget Calculator – A Simple Rule for Smarter Money Management

2. Create an Emergency Fund

Everybody requires an economic cushion. An emergency fund insulates you from shocks—whether it’s medical bills, a sudden loss of employment, or emergency repairs at home. Financial advisors usually suggest saving between three- and six-months’ living costs in a liquid account.

Actionable Tip: Begin small. Simply putting aside part of your pay each month can gradually add up to a solid fund that provides you with comfort.

Try Emergency Fund Calculator – How Much Do You Need to Save?

3. Eliminate Debts and Have Good Credit

Having high-interest debt, such as credit card or personal loan debt, quickly offsets your financial health. Elimination of debt is a necessary step to clear the way for future investments. Good credit also presents opportunities for good loan conditions and financial freedom.

Actionable Tip: Prioritize paying off debts by addressing the highest interest balances first. Consolidation plans can also make it easier.

Try Free Credit Card Payoff Calculator – Get Debt-Free Smarter

Investment Options for Salaried Employees

After laying a good financial foundation, the next step is to get your money working for you. For salaried employees, the trick is to choose investment options that complement regular income flows, monthly contributions, and long-term objectives

1. Retirement Accounts

Why They Matter: Retirement plans, for instance, pension schemes or employer-provided plans, enable you to save regularly towards the future. The majority of the plans have employer matching contributions, which is basically free money to your retirement.

Actionable Tip: Fund any employer matches first before considering other investment options. Contribute at least sufficient amounts to maximize these matches—it’s a brilliant, risk-free return on your contribution.

Try Free Retirement Calculator – Plan Your Retirement with Confidence

2. Mutual Funds and Index Funds

Why They Matter: Mutual funds invest money from numerous investors in a diversified portfolio of securities, stocks, or bonds. Index funds, which monitor market indices, are a cheaper method of investing in diversified markets. These funds are particularly suitable for beginners because they diversify, reducing risk but still offering growth opportunity.

Actionable Tip: Seek out the lowest management fees and a steady track record of performance. Compounding returns has the power to make even small investments, when left alone over time, very impressive returns.

3. Stocks and Dividend Investments

Why They Matter: Investing in stocks can be lucrative, providing both capital appreciation and income in the form of dividends. If you invest in solid firms—traditionally referred to as blue-chip stocks—you can enjoy periodic dividend payments, which can help supplement your income or be reinvested to further compound your gains.

Actionable Tip: Start with a portion of your portfolio invested in stocks. As you acquire experience, diversify over industries gradually to control risk without minimizing potential return.

Try Free ROI Calculator – Calculate Your Investment Success

4. Bonds and Fixed-Income Securities

Why They Matter: For individuals who like to keep their investments low-risk, bonds provide periodic interest payments over a specified time. Government bonds are especially stable and can be a safe haven amidst turbulent market conditions. They act as a stabilizer in a diversified investment portfolio.

Actionable Tip: Consider creating a balanced portfolio with a mix of bonds and stocks. This strategy not only preserves capital but also provides a consistent income stream, which is particularly attractive for salaried individuals who depend on steady cash flow.

5. Real Estate and REITs

Why They Matter: Real property is a physical asset that has a history of appreciating over the long term. Whether you’re purchasing property outright or investing in Real Estate Investment Trusts (REITs), real property provides an added degree of diversification in your investment portfolio. REITs, in turn, enable you to invest in real property markets without having to own a property yourself.

Actionable Tip: If investing in property is not feasible on a financial basis, begin small with REITs or take the fractional ownership platforms route wherein you can build your real estate portfolio slowly with lower initial outgo.

6. Systematic Investment Plans (SIPs)

Why They Matter: Especially successful in countries such as USA and more so in other nations, SIPs enable you to invest in mutual funds regularly irrespective of market volatility. If you invest a fixed sum at regular intervals, you are availing yourself of the facility of rupee cost averaging that can reduce the effect of short-term market fluctuations.

Actionable Tip: Set a specific amount you can afford to invest each month. Through the years, this regular, disciplined practice can take advantage of compounding, and small amounts of money can add up to a significant nest egg.

Master Your Finances with a Monthly Budget Planner

7. Side Ventures and Skills Investment

Why They Matter: Spending in your career or side business can pay dividends many times over. At times, the best investment is not stocks or property but yourself. Upgrading your skills, getting more education, or even creating an online business can result in greater income and financial independence.

Actionable Tip: Invest in a small amount of your income to enhance your skills—be it through seminars, online courses, or smart side hustles. Not only does this diversify your incomes, but it also builds up your general financial strength.

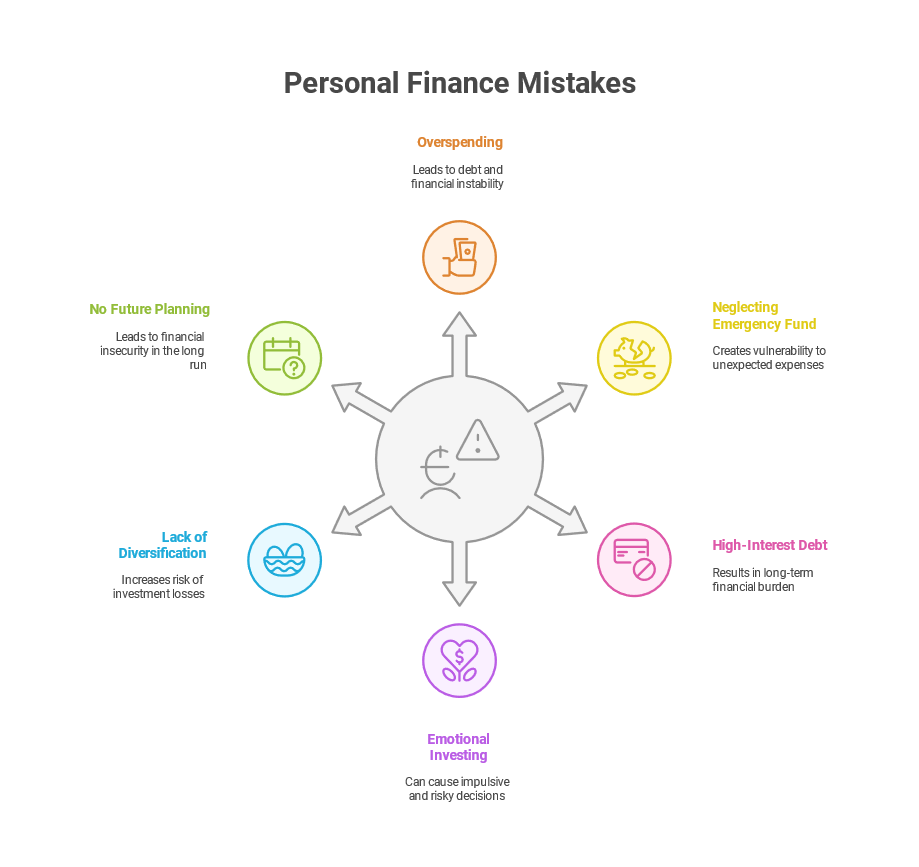

Common Mistakes to Avoid in Personal Finance

Despite the best of intentions, most people end up making habitual mistakes that do not allow them to gain financial stability. Identifying these mistakes at an early stage is the difference between short-term success and long-term success.

1. Not paying attention to budgeting and overspending

How to Overcome It: Develop a system to record your spending—whether that’s a budget spreadsheet or a dedicated app. Set realistic spending limits and reassess your habits periodically to ensure you’re on track.

2. Neglecting an Emergency Fund

How to Overcome It: Prioritize saving, even if it’s a bit each month. As your earnings increase over time, incrementally add to your emergency fund until you have between three to six months of living costs safely stored.

3. Accumulating High-Interest Debt

How to Overcome It: Prioritize paying off high-interest debts first. Look into debt consolidation strategies and be very vigilant against using credit for discretionary spending.

4. Emotional and Uninformed Investing

How to Overcome It: Learn with credible sources and seek the services of a financial advisor if necessary. Create an investment plan that fits your risk tolerance, financial objectives, and time horizon. Be disciplined and adhere to your plan even when there’s market volatility.

5. Failing to Diversify

How to Overcome It: Strive to make a diversified portfolio that has an assortment of equities, bonds, and alternative sources of funds such as real estate or even a part-time business venture. Diversification not only protects one from market slumps but also opens the door to more stable growth.

6. Not Planning for the Future

How to Break It: Establish both short- and long-term financial objectives. Monitor your progress regularly, rebalance your investments whenever necessary, and never lose sight of the future. Having a vision for your future life can be a strong incentive for responsible financial conduct.

A starting point in establishing SMART financial goals is being aware of your take-home pay. Our Income Tax Estimator 2024/2025 enables you to work out your after-tax income, making your goals more realistic and attainable.

Putting It All Together: Charting Your Financial Journey

- Learn the Basics: Discover what personal finance is all about beyond the spreadsheets and numbers. It’s about attitude, discipline, and getting your money to work for you.

- Build a Solid Base: Develop a doable budget, establish an emergency fund, and pay off high-interest debt. A solid base shields you from tough times.

- Invest Wisely: Determine your investment choices that are aligned with your salary and lifestyle. Whether it’s adding to retirement funds, investing in mutual funds, or venturing into real estate deals, every move counts toward wealth creation.

- Avoid Pitfalls: Stay away from pitfalls like overspending, emotional investing, and ignoring diversification. Identify such hurdles early on, and make a change proactively.

Make It Personal

Don’t forget that there’s no “one-size-fits-all” solution to personal finance. Your experience will be special. What suits one may not suit another. Allow yourself time to get to know your financial habits, your goals, and even your anxieties. This knowledge will enable you to adapt the lessons from these books to develop a customized financial plan that fits your goals in life.

Action Plan for Beginners

- Start Small: Start out by monitoring your spending. Establish a basic monthly budget and gradually improve it as you determine trends and obstacles.

- Educate Yourself: Take some time reading or condensing main points from suggested books. At times, in-depth information in personal finance may bring about the psychological change to transform tendencies.

- Plan and Prioritize: Establish concrete, realistic financial objectives: short-term (saving a set amount), medium-term (establishing a savings cushion), and long-term (investing for retirement or some other big-ticket purchase).

- Revisit and Revise: Personal finance is not static. Periodically review your budget and investment portfolio, making changes as your income, outlays, and objectives evolve over time.

Looking Ahead

With proper mindset and tools, personal finance is no longer a daunting task but a journey to real financial freedom. Above all, it empowers you—once being just a salary earner, now in control of managing and building wealth.

Conclusion

Personal finance isn’t magic; it’s a practice. It’s about consistently making choices that align with your long-term goals, learning from mistakes, and continuously challenging yourself to improve. Whether you’re just starting with a basic budget, setting up your first SIP, or exploring diversified investments, the path forward is built on small, informed decisions that over time add up to significant gains.

By understanding what personal finance truly means, investing in opportunities appropriate for your regular income, and steering clear of common pitfalls, you’re setting the stage for a more secure and fulfilling future. Remember, every journey begins with a single step—so take that step with confidence, and let your financial story be one of resilience, preparation, and growth.

In short, personal finance is so much more than figures on a page—it’s an empowering study that walks you through budgeting, saving, and investing, while also protecting you from pitfalls that can stop you in your tracks. For the salaried worker, such practical investment vehicles as retirement plans, diversified mutual funds, blue-chip stocks, bonds, real estate opportunities, and even personal growth projects offer an avenue to solid wealth creation. And by steering clear of missteps like overspending, forgoing emergency funds, or making hasty investment choices, you lay the groundwork for a flourishing financial future.

If you’re ready to seize the reins of your financial fate, take an active learning approach from these resources and begin with small but meaningful changes. And remember, every strong financial journey starts with one, wise choice.

Happy saving, investing, and growing—your financial future awaits!

Ready to take control of all your financial goals? Discover all our powerful tools, including retirement, savings, and mortgage calculators, in our comprehensive list of free Financial Calculators.

One Comment