The last couple of years have irreversibly stretched family budgets all over America. With high inflation continuing to increase the price of daily necessities and high interest rates increasing the cost of borrowing, most are experiencing the strain. Learning how to manage money in high inflation and interest rates is one of the most important financial skills in today’s economy.This guide will show you how to manage money effectively in high inflation and high interest rate environment, providing practical strategies to make your money go further. Economists affirm this fact: “in periods of inflation, prices increase, and currency devalues.” This raises an important question in all minds: “how to make my money stretch?”

How to Manage Money in High Inflation and Interest Rates

There are effective strategies to adjust. This detailed book offers actionable, step-by-step guidance on:

- Budgeting in high inflation

- Saving money on increasing costs

- Managing debt effectively

- Smart investment options for high interest rates

- Best ways to protect your savings from inflation

Let’s get started and turn financial fear into empowered financial action.

Budgeting in High Inflation: Regaining Control Over Your Expenditure

It is important to know and manage where your money is headed. In periods of inflation, some expenses will balloon more than others.One of the first steps to effectively manage money in high inflation and high interest rate environments is to gain control over your household budget.

How to Manage Money in High Inflation: Cut Expenses Wisely

Begin by carefully going through your budget to find categories that are most affected by the rise in prices. Studies tend to indicate that groceries and gasoline are the first categories where consumers feel the pinch. Once you have pinpointed them, you can make specific reductions:

Food Savings:

- Choose store-brand or generic food, which is usually of similar quality at a lower cost.

- Meal plan for the week. This helps avoid impulse purchases and wasted food.

- Shop sales, clip digital coupons, and buy in bulk when it’s really cheaper on non-perishables.

- Check out discount grocery stores or nearby farmers’ markets for the better bargain.

Transportation Cost Management:

- Cluster errands to reduce fuel use.

- Participate in gas-rewards or club programs.

- Keep your car in good shape (correct tire pressure, oil changes) to get best fuel mileage.

- Little things such as losing unnecessary weight from your trunk and engaging cruise control can make a difference.

Utility Bill Savings:

- Acquire energy-saving routines: wash full loads in washing machines/dishwashers, replace HVAC filters periodically, turn off lights/electronics when not occupied.

- Install smart home devices to provide automatic energy saving.

Restrict dining out

- If you must dine out, search for bargains, split the bill, or order shared meals.

- Audit and cancel unused memberships or streaming services. Each dollar you save on these “nice-to-haves” adds directly to your budget

Each dollar you save using these mindful decisions easily mounts up, providing real comfort for your family budget in times of inflation. When you manage money in high inflation and interest rates, focus on cutting discretionary expenses and locking in fixed-rate loans.

Increase Your Income Cleverly

If trimming costs by itself won’t solve your budget shortfall, try boosting income. A part-time job, anything from freelance work in your skill set to gig-economy driving or delivery, is a good place to look for padding. Even an extra hour or two a week can be enough to counteract increasing expenses.

A warning in advance: Avoid “lifestyle creep.” Make sure any excess money goes toward necessary expenses, debt repayment, or savings, not toward new, indulgent expenses. This keeps your efforts working positively toward your goals.

Clever Ways to Save Money on Increasing Expenses

In addition to fundamental budgeting, forward-thinking measures are essential to “how to save money with growing costs.”

Shop Around & Take Advantage of Deals

- Don’t Settle: Avoid automatically remaining with the same stores and services. Periodically compare prices online as well as in your local community.

- Food Shopping Savvy: In addition to discount supermarkets, take advantage of store apps for mobile coupons and loyalty programs. Think about sharing bulk buys with friends or family.

- Fuel Finder Apps: GasBuddy-type apps will assist you in finding the cheapest gas stations in your vicinity, saving you heaps in the long term. You could also consider changing to a supermarket group offering gas-rewards programs.

- Coupons and Rewards: Make it a point to actively look for digital coupons, cash-back rewards, and loyalty points. Even tiny rebates on daily essentials add significantly to your savings in the long term.

Negotiate Your Bills – managing money during inflation

Many individuals overlook this powerful strategy. Make it a habit to review each regular bill (insurance, internet, phone, subscriptions) at least twice a year and attempt to negotiate a better price.

- Be Prepared & Polite: Research competitor offers before calling. Refer to your loyalty and politely explain your budget constraints.

- Ask to See a Manager: If attempts at the first level fail, request to speak to a manager or the “customer retention” department. Providers usually have more incentive to give you a discount or promotion to keep you as a customer than to lose you.

- Bundle Services: Check for bundling discounts (e.g., for internet and mobile plans).

- Check Insurance: Auto and home insurance premiums may change. Compare rates with new quotes on an annual basis.

Spending even 10-15 minutes on a phone call can lead to substantial, recurring savings. The core principle is to proactively manage your expenses rather than passively letting costs creep up.

Controlling Debt Inflation: finance strategies for high interest rates

High interest rates can make debt particularly burdensome, as the cost of borrowing increases. Strategic debt management is crucial. Successfully managing money in high inflation and high interest rate environments also heavily relies on strategically tackling your debt, as the cost of borrowing becomes particularly burdensome.

Prioritize High-Interest, Variable Debt

- Pay Target Credit Cards First: Credit cards and adjustable-rate loans generally carry variable interest rates that increase when the central bank hikes its benchmark rates. Experts across the board advise paying off these debts aggressively first. Each dollar you put towards a credit card balance cuts off further high-interest charges from building up.

- Emphasize the “Debt Avalanche” Strategy: This effective method requires you to pay minimum on all debts but the one with the highest rate of interest. After clearing the debt with the highest rate of interest, you roll over the amount you had been paying on it into the next highest-rate debt. The higher the interest rates, the lesser the amount of total interest paid in the long run.

Refinancing Loans When Managing Money in High Inflation

- Lower-Interest Loans: If you have several high-interest debts, try consolidating them into one loan with a lower, fixed interest rate. Possibilities include a fixed-rate personal loan or a home equity loan (if you own a residence) to pay off credit card debt.

- 0% APR Balance Transfers: A few credit cards have promotional 0% APR balance transfers for new cardmembers. If you qualify, paying off high-interest balances can get you a year or more of interest-free payments. Importantly, be sure you can pay off the balance you transferred before the promo ends to avoid deferred interest or high post-promo APRs.

Revise Your Debt Paydown Budget

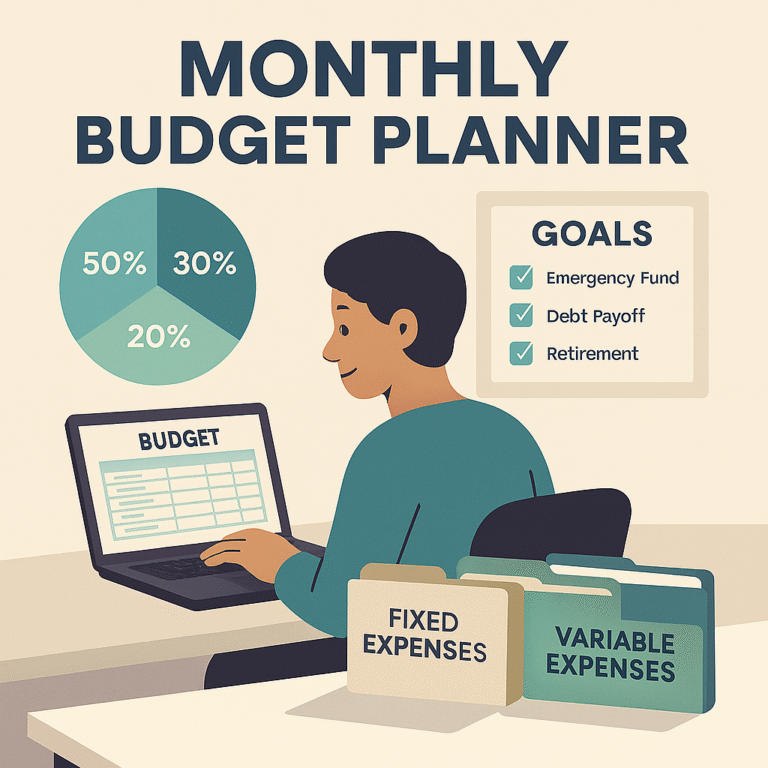

- Put More towards Debt: Review your budget to identify additional money for paying off debt. One popular guideline is the 50/30/20 rule: 50% to needs, 30% for discretionary spending, and 20% for savings and paying off debt.

- Utilize Budgeting Tools: Use a budget calculator spreadsheet or a special budgeting app to monitor your progress and remain accountable. (See SmartWealthLoop’s free 50/30/20 Budget Calculator to assist you in getting started!)

Understanding “Good” and “Bad” Debt

Not all debt is the same. If you have a fixed-rate mortgage with rates pre-locked prior to recent rate increases, you’re probably in a good situation. Your mortgage rate could now be lower than the current inflation rate, essentially making the loan less expensive to maintain. In such situations, focus on paying off higher-interest, floating debt instead of prepaying a low-interest, fixed-rate mortgage aggressively.

Smart Investing Tips to Manage Money in High Inflation and Interest Rates

Investing when interest rates are high demands making adjustments to your portfolio. To effectively manage money in high inflation and high interest rate environments from an investment perspective, strategic adjustments to your portfolio are essential.

Shorten Maturities & Use Ladders

- Invest in Short-Duration Bonds: Increasing interest rates tend to negatively affect long-term bonds more (their prices decline more). Moving into short-duration bonds or short-term bond funds can minimize interest rate risk. Although they pay lower yields in the beginning, they reset more quickly as rates rise.

- Bond Ladders: A bond ladder strategy entails purchasing a combination of bonds that mature at various times. This gives you liquidity and enables you to reinvest maturing money at possibly higher rates if rates keep increasing, minimizing reinvestment risk.

Embrace Inflation-Indexed Securities

- Treasury Inflation-Protected Securities (TIPS): TIPS are government securities whose face value changes with inflation, preserving your buying power. Schwab observes that TIPS yields recently have hit the peak of a 20-year cycle. For instance, a 5-year TIPS might provide a market-attractive nominal yield if inflation continues.

- U.S. Series I Savings Bonds (I Bonds): These inflation-protected government-backed bonds are a great method of safeguarding savings against inflation. They provide a composite rate that adapts to inflation (now approximately 3.98% as of May–Oct 2025). I Bonds assure to outpace inflation and never lose principal. They can be purchased through TreasuryDirect.gov, although there is a yearly purchasing limit ($10,000 per person).

Investigate Floating-Rate Funds

Variable-Rate Exposure: Certain bond funds hold variable-rate loans or bonds. Coupon payments on them rise as market rates increase, potentially generating more than the conventional fixed-rate bonds if rates are rising. For specific bond exposure, consider inflation-indexed ETFs or floating-rate ETFs.

Equities with “Pricing Power” & Value Stocks

- Pricing Power Firms: Under inflationary conditions, look for firms that can transfer higher costs to the consumer without losing market share disproportionately. Industry groups such as energy and commodity play firms tend to do well when raw material prices go up. Consumer staples, healthcare, and utility firms generally enjoy steady demand irrespective of the state of the economy.

- Value Stocks: Recent experience indicates that value stocks tend to beat growth stocks in the face of economic uncertainty and rising rates. Value stocks tend to be banks, industrials, and consumer businesses that are selling at lower multiples. These frequently dividend-paying shares tend to be less vulnerable than high-growth, high-multiple technology stocks in a turbulent environment. (For more on investment psychology, see The Psychology of Money by Morgan Housel.)

Don’t Forget Cash & Cash Equivalents

- High-Yield Savings Accounts (HYSAs) & Short-Term CDs: With top rates, even cash can return a decent amount. Placing an emergency cushion in a HYSAs (usually earning 4-5% APY) or short-term Certificates of Deposit (CDs) is a wise, low-risk move. Though not an investment approach to hold long-term, it keeps your liquidity performing better than a regular checking account.

- In total, a well-diversified portfolio comprised of inflation-linked bonds, companies with pricing power, value equities, and a judicious allocation to cash provides stability and robustness in a high-rate world.

Many investors struggle to manage money during high inflation and rising interest rates, but simple strategies like budgeting and diversifying assets can help.

Best Ways to Protect Your Savings from Inflation (Non-Investment)

Aside from your investment portfolio, taking an active step in protecting your liquid savings is important. Beyond active investing, knowing the best ways to protect your savings from inflation is a critical part of learning to manage money in high inflation and high interest rates.

Maximize Returns on Low-Risk Funds

- High-Yield Savings Accounts (HYSAs): As noted, transfer your emergency fund and any temporary savings to a high-yield online savings account. These can provide 3-4% APY or higher with minimal risk, keeping your cash ahead better than a typical bank account.

- U.S. Series I Bonds: For some portion of your long-term cash that you do not expect to need to access immediately (they must be kept for a minimum period of one year), I Bonds are an excellent inflation hedge. The composite rate ensures your money will earn you more than inflation. Don’t forget the yearly buying limit.

- Treasury Bills (T-Bills) / Certificates of Deposit (CDs): Consider laddering short-term U.S. Treasury bills (4-52 weeks) or bank CDs priced conservatively when rates are high. This will enable you to lock in good rates for certain periods and reinvest at maturity.

Consider Currency Diversification (Advanced)

- Small Foreign Exchange Exposure: For large cash balances, a small portion to foreign exchange (e.g., Euros or Yen, usually through a foreign currency fund or ETF, but not actual cash) can serve as a hedge if the US dollar loses strength compared to other major currencies, safeguarding from domestic inflation.

- Recall, saving protection is both beating inflation and preserving purchasing power. Keep risk low on your core cash positions while allowing a fraction to ride in inflation-linked securities.

- Negotiating Bills & Increasing Income: Your Financial Control Panel

- Lastly, never undervalue the leverage of straight negotiation and boosting your income. A survey in 2024 found that two-thirds of Americans perceive themselves as poorer from inflation, yet most are unaware they can negotiate discounts actively.

Negotiating Bills & Increasing Income: Your Financial Control Panel

Lastly, never undervalue the leverage of straight negotiation and boosting your income. A survey in 2024 found that two-thirds of Americans perceive themselves as poorer from inflation, yet most are unaware they can negotiate discounts actively. As part of learning to manage money in high inflation and high interest rates, never underestimate the power of direct negotiation and supplementing your income.

Master the Art of Negotiation

- Review Biannually: Put a reminder on to check all of your regular bills (streaming, internet, phone, utilities, insurance) every six months.

- Make the Call: Call companies and civilly inform you’re looking at your budget or checking out competitor prices. Most carriers want to give a discount or special offer to keep you as a loyal customer.

- Take Advantage of Discounts: Don’t hesitate to ask about student, military, senior, or professional association discounts if you’re eligible. Bundling plans (e.g., phone + internet) can also result in substantial savings.

Creative Income Generation

- Side Gigs & Hobbies: Is it possible for a hobby to be an income stream? Online teaching of a talent, selling handmade things (such as your Etsy printables!), or gig-economy labor (driving, delivery, freelancing) can really add to your main income.

- Direct Funds Strategically: Make any additional money earned go directly toward your highest priority expenses (food, gas, paying off debt) instead of discretionary spending.

Conclusion: Manage Money in High Inflation with SmartWealthLoop

By practicing frugality, managing your debt sensibly, investing wisely, and working hard to keep your savings ahead of inflation, you can ride out this period of inflation. It is not always going to be comfortable, but it is certainly doable.you can effectively manage money in high inflation and high interest rates As budgeting guru Dave Ramsey is in the habit of reminding us, “This. Isn’t. Forever.” These money-pinching techniques are potent remedies to tide you over until the prices settle down.

For more tailored assistance, check out SmartWealthLoop’s resources – including our free 50/30/20 Budget Calculator and other tools – to create a clear plan on your own terms. Keep in mind: knowledge paired with taking action is your best bulwark against inflation and high interest. Stay educated, stay vigilant, and you will ride out this storm even stronger.

FAQs Manage Money in High Inflation

- How do high inflation and interest rates impact my own finances?

High inflation raises the price of goods and services, decreasing your purchasing power. High interest rates increase borrowing (e.g., credit cards, loans) costs and affect the returns on investments, making saving and paying off debt more difficult. - What are the best ways to budget under high inflation?

The most efficient tactics are to carefully monitor your expenditures to see where they’re most aligned with inflation (such as food and fuel), then cut there in a focused manner. Think about planning meals, clipping coupons, grouping errands, and negotiating on those recurring bills. Raising your income with a side gig can also be essential budgeting help. - What are the best ways to protect my savings from inflation?

To keep your savings safe, look at high-yield savings accounts (HYSAs) and U.S. Series I Bonds, both of which pay returns tied to inflation. Laddering short-term CDs or Treasury Bills can help you benefit from higher rates too. Diversifying a small part into foreign currency funds could be an advanced solution. - How do I change my investment approach when interest rates are high?

When interest rates are high, take down bond maturities, look at inflation-indexed instruments such as TIPS and I Bonds, and examine floating-rate funds. In stocks, emphasize corporations with “pricing power” (those able to pass on costs) and value stocks, which perform better during uncertain economic environments than high-growth technology stocks. - What is the most effective strategy for holding high-interest debt at this time?

Pay off variable, high-interest debt first, such as credit cards, with strategies such as the “debt avalanche.” Carefully consider rolling over several high-interest debts into one, lower fixed-rate loan or taking advantage of 0% APR balance transfers (if you can retire it before the promo period ends). Further, devote a larger percentage of your income to debt repayment in your budget.